The U.S. economy recession looms ever closer, casting a shadow over the nation’s financial stability. As the ripple effects of the ongoing trade war continue to take their toll, experts warn that the resulting economic downturn could be more profound than initially anticipated. Recent data from the consumer sentiment index reveals a troubling dip in public confidence, raising alarms about potential impacts on spending and investment. Concurrently, the stock market crash has added another layer of uncertainty, prompting the Federal Reserve to reconsider its approach to interest rates. With each of these factors intertwined, understanding the nuances of this impending recession has never been more crucial for American households and investors alike.

The possibility of a significant economic downturn in the United States is becoming an increasingly pressing concern. As trade tensions escalate and market instability ensues, many analysts are sounding alarms about a potential financial crisis. Indicators such as the consumer polling data and shifts in investor behavior suggest a waning optimism among the public. Moreover, the ramifications of rising interest rates from the Federal Reserve add complexity to the already challenging landscape. Exploring these interconnected elements is essential to grasp the broader implications for the nation’s fiscal health.

Understanding the U.S. Economy Recession Risk

As analysts predict a possible recession for the U.S. economy, it is crucial to examine the underlying factors contributing to this sentiment. The ongoing trade war, fueled by tariffs imposed on American goods by countries like China and Mexico, has left many investors concerned about prolonged economic strain. Historically, economic downturns are characterized by reduced consumer spending and a faltering job market, both of which appear to be emerging as potential realities in the current economic landscape. Moreover, the University of Michigan’s consumer sentiment index has plummeted, indicating a decline in confidence among American consumers, a critical driver of economic growth.

Additionally, the fear of a recession is exacerbated by rising uncertainties regarding government policies and fiscal stability. The chaotic nature of recent trade negotiations and their repercussions on the markets have led businesses and consumers alike to adopt a cautious approach, often reflected in “wait and see” investment strategies. This unpredictability can contribute to a downward spiral of consumer spending, which in turn would negatively impact employment rates and overall economic health. It is essential to monitor these developments as they unfold, as they may very well dictate the trajectory of the U.S. economy in the near future.

Impacts of the Trade War on the U.S. Economy

The ramifications of the trade war are multifaceted, affecting not only the stock market but also the overall consumer sentiment index. Tariffs designed to protect domestic industries have often resulted in retaliatory measures from affected countries, which can harm U.S. exporters and lead to increased prices for consumers. As businesses face higher operational costs, they may pull back on hiring and investment, triggering a ripple effect across various sectors. If businesses slow down, this could lead to a decline in productivity, further deepening economic difficulties.

Furthermore, the trade war creates an environment of uncertainty that discourages consumer spending. Consumers tend to feel less secure when the economy is volatile, and when the trade war escalates, their apprehensions about job stability and income can lead to reduced spending. With a significant portion of the U.S. economy grounded in consumer expenditures, a downturn in shopping or investment can exacerbate economic conditions and plunge the nation closer to a recession. The intertwining of these issues paints a worrying picture for the U.S. economy as it navigates this turbulent period.

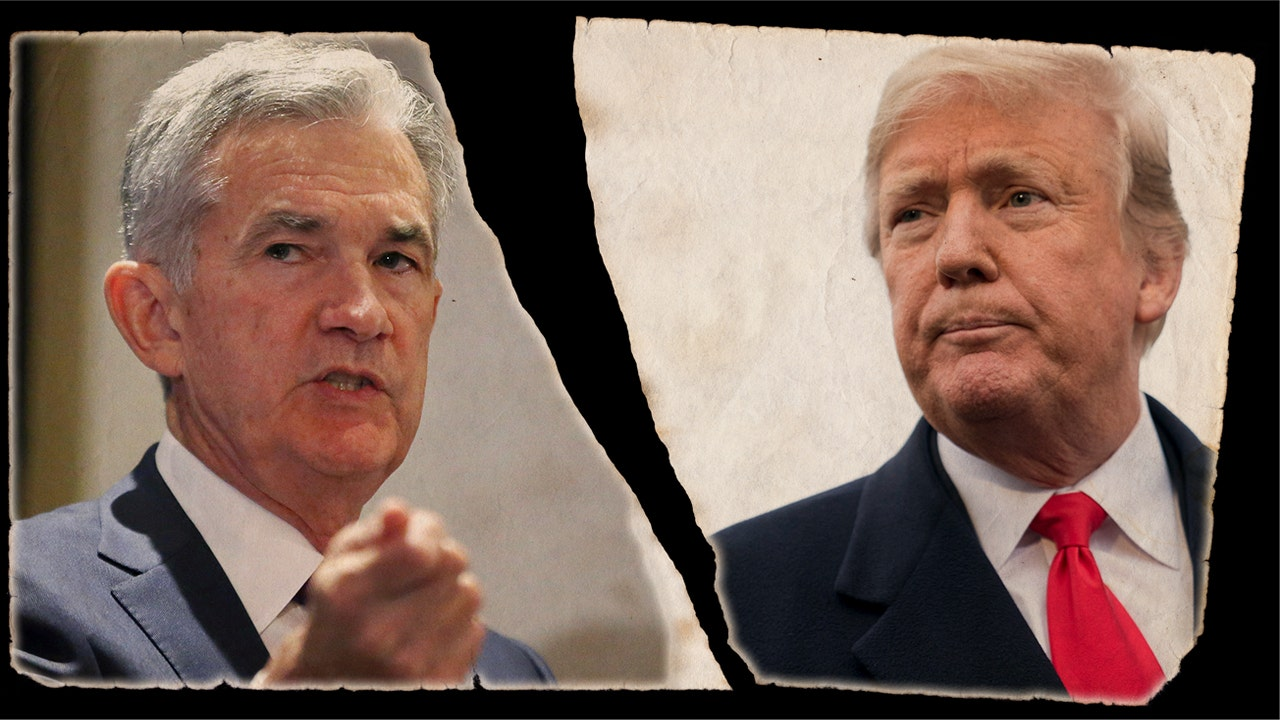

Federal Reserve Interest Rates: A Dilemma

The Federal Reserve’s role becomes crucial during times of economic uncertainty. With fluctuating market conditions arising from the trade war and changing consumer behaviors, the Fed faces a tough decision regarding interest rates. If they choose to lower interest rates, it can encourage borrowing and spending, potentially fostering a more robust economy. However, lowering rates may also stoke inflation, a risk the Fed must balance carefully. On the other hand, keeping rates high could hinder economic growth, further increasing the risk of a recession.

Given the current economic landscape, characterized by rising fears of a stock market crash and precarious consumer confidence, the Fed might lean towards maintaining interest rates. This is particularly prudent in light of the uncertainties surrounding inflation and the ongoing impacts of the trade war. By holding steady, the Fed can provide a stabilizing force in a turbulent economy and reassess the situation as additional data becomes available. Ultimately, the decision will aim to protect the economy while attempting to mitigate potential recession risks.

Consumer Sentiment Index: A Harbinger of Economic Health

The University of Michigan’s consumer sentiment index is a vital indicator of the broader economic climate. A declining index suggests that consumers are feeling less optimistic about their financial futures, often leading to a decrease in spending. With fears of a recession looming, understanding what drives consumer sentiment is essential in predicting the economic trajectory. A strong consumer sentiment typically supports economic growth, while a weak sentiment likely leads to stunted growth or decline.

Moreover, consumer sentiment can significantly impact the stock market. As consumers scale back on spending due to pessimistic outlooks, businesses may face decreased revenues, which can lead to lower stock valuations. This cycle of declining consumer confidence and stock performance can foster an unsettling environment, prompting more investors to withdraw from the market. In this regard, maintaining a healthy consumer sentiment index is crucial for stimulating economic activity and warding off recession.

Navigating the Stock Market Amidst Uncertainty

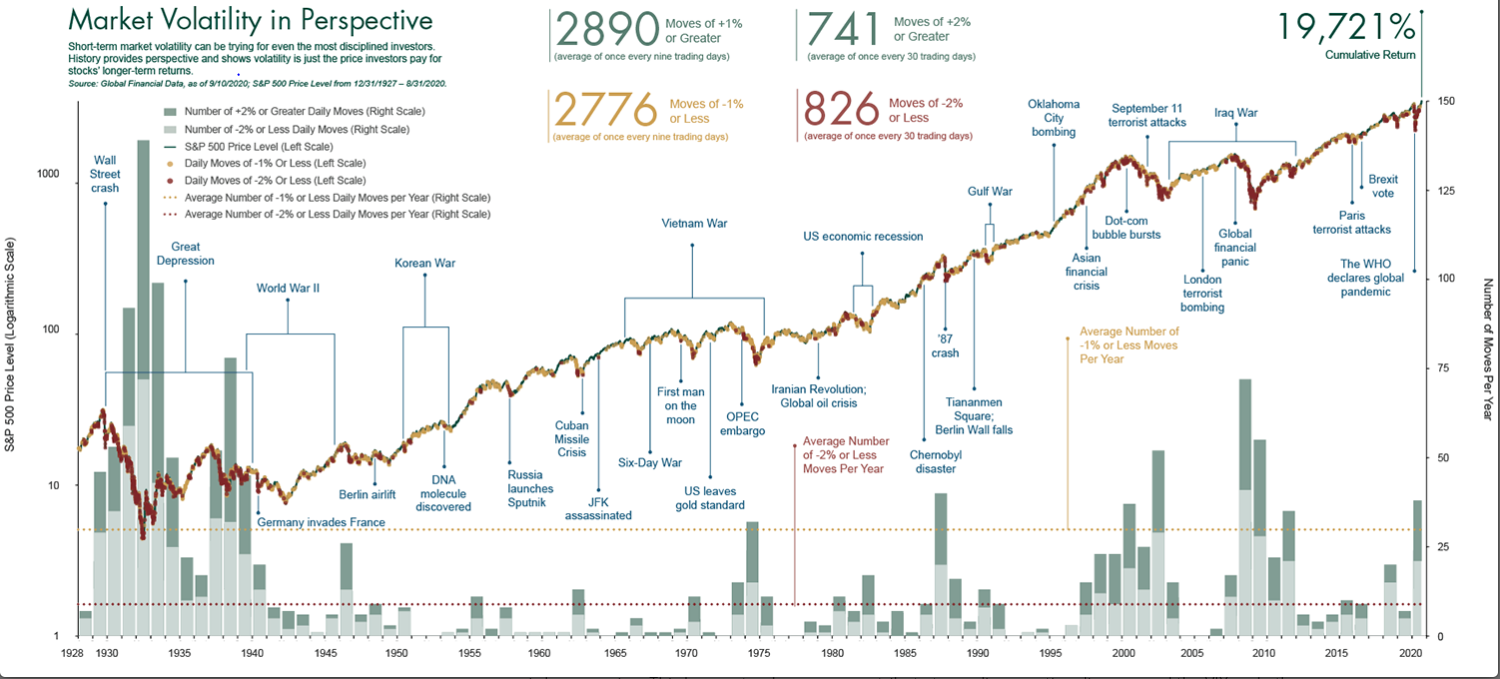

The stock market has recently experienced heightened volatility, largely attributed to the uncertainty surrounding the trade war and economic policies. A stock market crash not only affects investors and companies directly but also influences consumer perception. As stock prices drop, consumer fears regarding the economy often exacerbate, leading to a decline in spending habits. This cyclical relationship underlines the significance of addressing stock market concerns to stabilize consumer sentiment and ultimately, the economy.

To navigate these turbulent waters, businesses and investors must remain informed about government decisions and global market movements. While it’s common for stock markets to experience fluctuations, prolonged periods of uncertainty can cause lasting damage to economic growth. Investors should be diligent in assessing risks and opportunities presented by federal policy changes and global trade patterns, as these elements are intertwined with the broader narrative of the approaching U.S. economy recession.

Federal Reserve’s Strategies During Economic Turbulence

As the U.S. economy faces increased risks due to external factors such as the trade war and shifting consumer confidence, the Federal Reserve must formulate strategies to mitigate potential fallout. One key approach may involve monitoring inflation rates meticulously while adjusting interest rates selectively to influence economic activity. The challenge lies in finding a balance; rate cuts can stimulate borrowing and spending, but could also fuel inflation if the economy does not respond positively.

Additionally, the Fed might consider innovative monetary strategies, such as quantitative easing, to inject liquidity into the economy without directly adjusting interest rates. These tactics aim to stabilize markets while providing support during periods of economic distress. As policymakers deliberate the best course of action, constant communication with the public will be paramount to managing expectations and promoting consumer confidence amid prevailing uncertainties.

Recession Indicators: Understanding Key Economic Signals

In the realm of economic forecasting, certain indicators can help predict the probability of a recession. Among these are rising unemployment rates, decreasing consumer spending, and stagnant GDP growth. The current climate, marked by sluggish hiring and negative outlooks from the University of Michigan’s consumer sentiment index, raises flags for potential recession. Investors and policymakers must remain vigilant and adapt proactively to evidence suggesting a downturn.

Moreover, external shocks, such as the impacts of tariffs and potential government fiscal crises, can exacerbate existing risks. As these pressures mount, it is essential to track consumer behavior and market performance closely, as their fluctuations may serve as early warnings of a deeper economic slump. By understanding these signals, stakeholders can make more informed decisions that align with both immediate needs and long-term economic recovery objectives.

The Future of the U.S. Economy: A Pessimistic Outlook?

Looking ahead, the outlook for the U.S. economy appears increasingly pessimistic. The combined effects of the trade war, declining consumer sentiment, and fears of a stock market crash position the nation precariously on the brink of recession. Economic growth may be hindered as investors adopt conservative strategies in response to uncertainties, leading to stagnation in hiring and spending. Addressing these challenges will require cohesive policies and strategic planning from businesses, investors, and government officials alike.

Despite these ominous signs, there remains a glimmer of hope for economic revitalization. If policymakers can effectively manage trade negotiations and foster more stable financial environments, they could restore confidence among consumers and investors. It will be paramount for leaders to demonstrate foresight and adaptability as the economic landscape continues to evolve amid global challenges and domestic uncertainties.

Frequently Asked Questions

What are the signs of a potential U.S. economy recession?

Signs of a potential U.S. economy recession include declining consumer sentiment index, heavy stock market losses, and increased risk perceptions, especially in light of ongoing trade wars. Economic analysts highlight that these factors can lead to reduced business investments and lower consumer spending, which are critical components for economic growth.

How does the trade war impact the U.S. economy during a recession?

The trade war significantly impacts the U.S. economy during a recession by creating uncertainty among investors and businesses. As tariffs increase, costs rise for American consumers and companies, which can exacerbate an economic downturn. Additionally, retaliatory tariffs from other countries can further strain trade relationships and economic growth.

How do Federal Reserve interest rates influence a U.S. economy recession?

Federal Reserve interest rates play a crucial role in either mitigating or exacerbating a U.S. economy recession. Lowering interest rates can encourage borrowing and spending, helping to stimulate economic growth. Conversely, if rates are kept too high to control inflation, it may hinder economic activity and deepen the recession.

What is the relationship between the consumer sentiment index and U.S. economy recession risk?

The consumer sentiment index reflects the overall confidence of consumers in the economy. A declining index often indicates heightened concerns about economic conditions, thus signaling an increased risk of U.S. economy recession as consumer spending, which drives economic growth, tends to decrease.

Could a stock market crash lead to a U.S. economy recession?

Yes, a stock market crash can lead to a U.S. economy recession by eroding consumer wealth and confidence. When stock prices fall dramatically, it can result in reduced spending by households, which is detrimental to overall economic activity. This, combined with other recessionary indicators like trade wars and high inflation, can set the stage for a recession.

| Key Point | Details |

|---|---|

| Trade War Concerns | Response from China, Mexico, and Canada to tariffs on American goods raises fears of a recession. |

| Consumer Sentiment Decline | University of Michigan’s index hits lowest level since November 2022, indicating reduced economic confidence. |

| Possible Recession Indicators | Risk of recession heightened by trade war, stock market performance, government spending cuts, and economic uncertainty. |

| Federal Reserve’s Dilemma | Faced with the need to balance interest rate cuts to support the economy without triggering inflation. |

Summary

The U.S. economy recession is emerging as a significant concern, with factors such as escalating trade wars and declining consumer sentiment contributing to fears of an impending economic downturn. Recent discussions point to various risks including stock market instability and potential government spending cuts, which signify an increasing precariousness in the economic landscape. As confidence continues to wane, it is imperative for policymakers to navigate these challenges carefully to avert a deeper recession.