The impact of federal funding on startups is paramount, especially in the realm of technology and biomedical research, where innovation flourishes in well-funded laboratories. Research funding serves as a crucial lifeline for burgeoning companies, enabling them to transform groundbreaking ideas into viable products that drive economic growth. Without adequate financial support from the government, many startups face insurmountable barriers, stifling entrepreneurship and limiting advancements in critical sectors. Moreover, when federal funding is threatened or cut, the consequences can ripple through the economy, hindering the development of startups in technology and ultimately affecting job creation and industry leadership. In essence, sustained investment in research not only fuels individual startups but also propels the U.S. toward its broader goals of innovation and progress.

When discussing the significance of governmental financial support for emerging businesses, particularly in the fields of technology and healthcare, it is essential to recognize how such investments influence overall entrepreneurial landscapes. Subsidies and research grants are vital for fostering new ventures that arise from scientific breakthroughs and academic achievements, encouraging innovation that drives economic expansion. Additionally, the interplay between federal grants and startup formation illustrates a symbiotic relationship where the success of one enhances the potential of the other. By nurturing startups through enhanced research budgets, policymakers can ensure that the United States remains a leader in entrepreneurship and technological advancements. Overall, the protection and promotion of federal funding are indispensable for sustaining the pipeline of innovative ideas that form the backbone of modern economic development.

Understanding the Role of Federal Funding in Biomedical Research

Federal funding serves as a cornerstone for biomedical research and plays an essential role in advancing innovations within the medical sector. Financial support from government bodies enables top research universities to explore uncharted areas of healthcare and develop groundbreaking technologies that can drastically improve patient outcomes. This funding is pivotal for maintaining laboratories, hiring talented researchers, and purchasing necessary equipment that allows for high-quality and impactful research. Without these funds, significant strides in medical advancements may be delayed or entirely skipped, leading to a stagnation in this crucial sector.

Furthermore, research funding is not solely about immediate outcomes; it fosters an ecosystem where knowledge transfer occurs readily among academia, industry, and startups. Institutions that receive substantial federal dollars often create partnerships with private enterprises, leading to innovations being brought to market faster. Studies indicate that for every dollar invested in federal biomedical research, the economic activity generated can skyrocket, proving that investment in research translates directly into rich returns for the economy.

Impact of Federal Funding on Startups

The impact of federal funding on startups is profound, particularly in the technology and biomedical fields. Startups often emerge from research conducted at universities, utilizing findings sponsored by federal grants to develop their products and services. The threat posed by funding cuts can lead to fewer startups entering the market because the initial stages of their development rely heavily on the foundational research supported by federal funds. Prospects for budding entrepreneurs can diminish, resulting in less innovative solutions to pressing healthcare problems and fewer economic opportunities.

Moreover, the interplay between federal funding and startup growth highlights the importance of continued investment in research and development. By sustaining financial support for academic institutions, we nurture not only the talents of emerging entrepreneurs but also the flow of pioneer ideas that transform entire sectors. The absence of these crucial funds can lead to a drastic reduction in the number of new ventures anticipated to flourish, which in turn places the entire innovation landscape at risk and undermines the expected economic growth.

The Importance of Research Universities in Entrepreneurship

Research universities are vital conduits for knowledge and innovation, especially in the realm of entrepreneurship. Universities like Harvard have become incubators for tech startups and biomedical initiatives, forging pathways between academic research and venture capital investment. Faculty and student-led research can lead to the commercialization of groundbreaking technologies, driven by the university’s strong support systems, including technology licensing offices and entrepreneurial mentorship programs.

This nurturing environment attracts not only local but also international talent, enriching the startup ecosystem. The robust entrepreneurship curriculum offered alongside access to top-tier resources positions universities at the heart of fostering entrepreneurship, creating a cycle of innovation that directly benefits economic growth. As students transition into the workforce or start their ventures, they carry forward the knowledge and skills gained, further solidifying the ties between education, innovation, and economic development.

The Ripple Effects of Research Funding Cuts

Cuts to research funding do not just affect the immediate financial landscape; they generate ripple effects that can be felt for years. Startups that rely on research for their product development face a prolonged timeline, as the cessation of funding results in fewer completed projects and innovations entering the market. As a result, venture capitalists may become more hesitant to invest in these startups, recognizing the increased risks associated with untested waters lacking foundation due to insufficient research.

The long-term implications can include a significant slowdown of new ideas reaching consumers, which is detrimental to economic growth. Historical data illustrates that the most successful startups often arise from heavily resourced environments where extensive research is conducted. Reduced funding can thus impede the entire innovation cycle, leading to a leaner pipeline of future companies that generate new jobs and drive economic prosperity.

Exploring the Entrepreneurship Curriculum at Leading Universities

Harvard Business School’s investment in its entrepreneurship curriculum showcases a strategic alignment between education and innovation. By providing students with comprehensive learning experiences and practical skills, the program not only prepares them for imminent challenges in launching startups but also encourages them to leverage the research taking place across the university. The robust entrepreneur network and resource access amplify the potential for students to devise unique business solutions drawn directly from ongoing research.

Moreover, the popularity of entrepreneurship as a field of study at such institutions highlights an emerging trend where students actively seek to merge academics with practical applications. This intersection underscores the critical role education plays in nurturing the next generation of entrepreneurs, enabling them to lead in sectors that rely heavily on research-driven innovations. Institutions are thus not just educational bodies but also engines of economic activity through the startups they help create and inspire.

Analyzing the Future of U.S. Innovation Amid Funding Constraints

The current landscape of U.S. innovation is at a crossroads due to funding constraints affecting research institutions. Experts articulate that the momentum in startup creation is influenced heavily by the availability of research funding, particularly in areas like technology and healthcare. As federal grants become less predictable, there is a growing concern that the nation’s competitive edge in innovation will weaken, causing setbacks that could take years to recover from.

In addition, the delay in research projects due to funding freezes directly correlates with a slowdown in breakthrough discoveries. Startups that depend on timely access to technological advancements may find themselves outpaced by competitors in more stable markets. The future hinges on strategic advocacy for robust funding structures that prioritize research, ensuring that the U.S. remains a leader in entrepreneurship and technological development.

Short-Term vs. Long-Term Effects of Funding Cuts

In evaluating the effects of federal funding cuts, a distinction must be made between short-term impacts and longer-term consequences on startups and research universities. Initially, startups may not feel the immediate effects of funding freezes; however, as the pipeline of new ideas originating from academic laboratories begins to dry up, the long-term implications become apparent. Innovative startups that would typically rely on the latest research findings to shape their products may find themselves disadvantaged in a rapidly evolving market.

Over time, the reduction in federally funded research can lead to a contraction of the entrepreneurial landscape. Emerging companies may struggle to fill the void left by cutbacks, leading to a decline in the overall number of startups and the potential for innovation in technology and healthcare. The quest for new solutions and advancements could falter, slowing progress toward substantial economic growth in these sectors.

The Link Between Research Funding and Tech Innovation

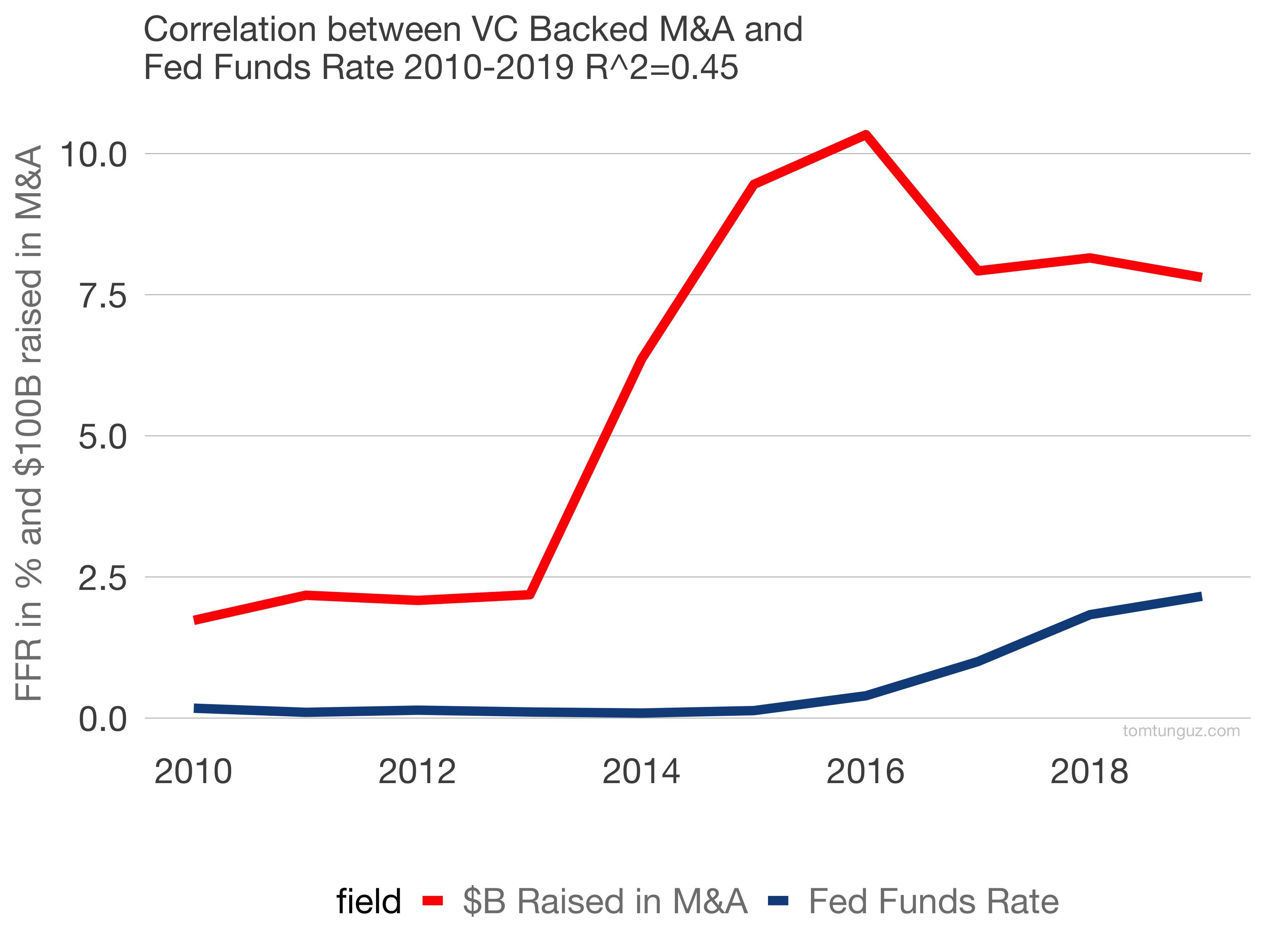

The link between research funding and technological innovation is both critical and complex. Increased investment in research is statistically proven to correlate with higher rates of advancements in technology and biomedical solutions. Federal funding lays the groundwork for groundbreaking research that translates into innovative startups, fostering economic growth and stability in the process.

Additionally, this investment catalyzes the development of new technologies with potential commercial applications, driving competition within the market. With each breakthrough backed by research funding, startups gain access to vital resources, enabling them to compete effectively against established companies, thus invigorating the overall economy. As such, the narrative surrounding research funding remains inextricably tied to the success and sustainability of the innovation ecosystem.

Strategies for Strengthening the Startup Ecosystem Amid Funding Challenges

To bolster the startup ecosystem in the face of funding challenges, it is essential to adopt an integrative approach that encourages partnerships between research universities, government entities, and private industries. Fostering collaboration can create alternative funding pathways and provide startups with the necessary resources to thrive despite uncertain federal funding landscapes.

Additionally, enhancing investment in small-scale grant programs may serve to safeguard promising research initiatives and startups. These supports would act as stopgaps, allowing innovative projects to persevere while navigating through broader funding restrictions. Ultimately, a holistic approach that combines federal, state, and private investments is crucial for nurturing a resilient startup ecosystem that can withstand disruptions.

Frequently Asked Questions

What is the impact of federal funding on startups in technology?

Federal funding plays a critical role in supporting startups in technology by providing necessary resources for research and innovation. When adequate funding is available, it fosters an environment where new ideas can flourish, leading to the creation of technology startups that drive economic growth.

How does research funding affect biomedical research startups?

Research funding is essential for biomedical research startups, as it supports the exploration of new treatments and technologies. Federal grants enable these startups to access advanced resources and collaborate with leading universities, significantly enhancing their chances of success in developing innovative health solutions.

Why is federal funding crucial for entrepreneurship in the U.S.?

Federal funding is crucial for entrepreneurship as it establishes a foundation for research and development. This funding supports innovation, creates job opportunities, and ultimately contributes to U.S. economic growth. Startups that rely on federally funded research often lead to breakthroughs that can transform industries.

What are the potential long-term effects of cuts to federal funding on startups?

Cuts to federal funding could result in a decline in the emergence of new startups, particularly in research-intensive fields like technology and biomedical science. Over time, this may hinder innovation and economic growth, as fewer startups will be capable of bringing groundbreaking ideas to market.

How can a freeze on federal research funding impact entrepreneurship?

A freeze on federal research funding can severely impact entrepreneurship by limiting access to essential resources that startups need to innovate and thrive. This could lead to decreased company formation, reduced research outputs, and ultimately a stifled entrepreneurial ecosystem, affecting the broader economy.

What role do research universities play in fostering startups?

Research universities serve as incubators for startups by providing access to cutting-edge research, fostering collaboration between faculty and students, and offering mentorship. Federal funding enhances these capabilities, enabling universities to support the commercialization of innovative ideas into viable businesses.

In what ways does federal funding contribute to economic growth through startups?

Federal funding stimulates economic growth by encouraging the development of startups that create jobs, advance technology, and increase productivity. Startups funded by federal grants often lead to significant economic activity and can generate substantial returns on investment for the economy.

What is the relationship between federal biomedical research funding and economic impact?

Federal biomedical research funding has a strong relationship with economic impact, demonstrating a return of $2.56 in economic activity for every dollar invested. This investment not only supports scientific breakthroughs but also fuels the growth of startups that translate research discoveries into commercial products.

| Key Points |

|---|

| The Trump administration froze over $2 billion in research grants at Harvard University, impacting science, medicine, and technology advancements. |

| Expected GDP shrinkage of 3.8% if funding cuts occur, comparable to the 2008-2009 Great Recession. |

| For every dollar invested in federal biomedical research, $2.56 in economic activity is generated. |

| Research universities are pivotal in connecting faculty and students to the startup ecosystem through innovation and entrepreneurship. |

| Federal funding is crucial for supporting labs, attracting talent, and fostering novel ideas for successful startups. |

| The freeze on funding is likely to slow the development pipeline for startups, with noticeable effects taking 1 to 3 years. |

Summary

The impact of federal funding on startups is profound, especially in the realms of scientific research and innovation. Disruptions in federal funding can inhibit not only the growth of individual startups but also the broader U.S. economy, as universities serve as critical incubators for entrepreneurship. The loss of funding leads to hiring freezes and canceled grants, stifling the emergence of new companies for years to come. Thus, maintaining robust federal investment in research is essential for ensuring the future vitality of both startups and the overall economy.